The recent inflationary surge is squeezing households, but not likely in the way you think. It’s hitting the wealthy disproportionately, new research shows.

Inflation peaked at 9.1% in June 2022, and has recently dropped to 3.4% in April, according to data collated by TradingEconomics. However, the inflation rate is still way higher than it was in the five years through 2020 when the Consumer Price index grew at a rate that hovered around 2% and sometimes went negative.

In many ways that stability was good for the economy. But the jump in inflation after the pandemic has hit everyone in the wallet, experts say. However, it’s also true some groups got hit harder than others.

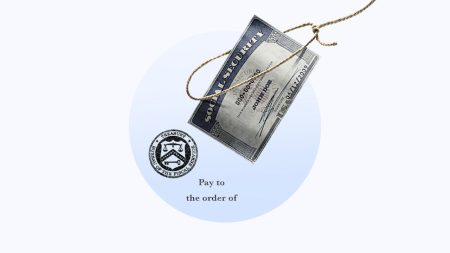

“Virtually all households are hurt by inflation,” states a recent working paper distributed by the National Bureau of Economic Research titled ‘Inflation’s Impact on American Households.’ “But richer households typically face larger percentage losses thanks to their higher share of asset income relative to labor income.”

Put simply, wealthier people tend to get more from their dividends or interest on investments rather than from salaries. The impact of inflation on the former (dividends and interest) is far greater.

“Inflation’s net taxation is highly progressive with the richest 1 percent experiencing nearly 2.6 times the average percentage decline in lifetime spending as those in the bottom quintile,” the paper states. It was authored by David Altig, Alan J. Auerbach, Erin F. Eidschun, Laurence J. Kotlikoff, and Victor Yifan Ye.

The authors use an example of someone in the top quartile of income would see a drop in inflation-adjusted spending of 9.84% if inflation jumped from zero to 10% per annum. However, someone in the 75th percentile would see a drop of 4.83% in spending, on average, according to the paper’s analysis.

The downside for the economy is richer people invest far more money into the economy which helps creates growth and creates jobs. If the rich feel squeezed fiscally then, rightly or wrongly, the rest of us suffer. Investment is a key variable in determining growth and most economists believe that without foreign and domestic investing any economy will suffer.

Findings from the paper also suggest that the inflation-tax (its tax because it robs people of the spending power of their savings) turns out to be a progressive tax. That means that the rich are hurt far more than the poor by this un-legislated hit to their wealth.

“Even were inflation fully anticipated and, thus, financially neutral, it would have a major and quite progressive impact, via the fiscal system, on the average level and distribution of Americans’ lifetime spending,” the report states. Put another way, the poorer you are the less inflation hurts your net worth. And it works vice versa also.

That’s something that the White House administration may find desirable at the moment given its leftward political leaning. However, what will happen to the economy if nominal in tax rate increases are added to the mix? How bad will that be for the U.S.

Read the full article here