So you’re dreaming of moving to the Golden State—but can you afford the cost of living in California? That’s a smart question to ask before you sell your house and load up a U-Haul with surfboards and sunscreen.

According to a 2020 Cost of Living Index, the average city in California has a 38% higher cost of living than the average city in the nation. Keep in mind, CA is the third largest state in the U.S. after Alaska and Texas—so the cost to live there varies dramatically from city to city. In fact, cities range from 5–98% higher in cost than the average U.S. city!1

In order to find out if you can afford life in the Golden State, you’d have to compare the cost of living in your current city with the CA city of your dreams.

To help you make a confident decision on whether California is right for you cost-wise, we’ll show you how much CA charges for “super fun” grown-up stuff like housing, food, taxes and bills.

Let’s get started!

Housing Costs in California

Okay, let’s kick things off with housing costs. In March 2020, median home prices in California were more than $600,000—nearly 88% higher than the national median of $320,000!2 Meanwhile, the median monthly rent for a two-bedroom apartment was almost $1,900—about 55% higher than the national median of $1,200.3 Ouch!

Sure, prices like those can take the wind right out of your sails. But remember, California is huge! So there’s hope in finding housing prices within your budget range when you look across the entire state.

Check out the cost differences between these popular CA cities:

|

California City |

Average Home Price |

Apartment Rent |

|

San Francisco |

$1,297,511 |

$4,200 |

|

L.A. |

$816,438 |

$2,800 |

|

San Diego |

$800,746 |

$2,391 |

|

Sacramento |

$440,447 |

$1,904 |

|

Bakersfield |

$330,317 |

$9794 |

While you might have to strike gold to afford housing near the Golden Gate Bridge, the state still has a city like Bakersfield that’s nearly 9% less expensive than the average U.S. city when you consider total housing cost factors.5

How to Handle Housing Costs in California

Whether you decide to rent or buy in your new city, first make sure you can afford it. Cross off any cities from your list that don’t allow you to keep your monthly housing payment to no more than a fourth of your take-home pay.

For home buyers who are getting a mortgage, that 25% limit includes principal, interest, property taxes, homeowner’s insurance, private mortgage insurance (PMI) and homeowners association (HOA) fees. Use our mortgage calculator to enter your down payment amount and try out different home prices within your budget.

If you want a smart mortgage you can pay off fast, talk to Churchill Mortgage about getting a 15-year fixed-rate conventional loan. Any other type of mortgage will drown you in interest and fees and keep you in debt for decades.

Find expert agents to help you buy your home.

If the high housing costs in California have you feeling bummed, hang in there. There’s hope to find a home you can afford when you work with the top real estate agents in the market. We make it quick and easy for you to find the best-performing agents who understand the challenges of buying a home in an expensive area. It’s their mission to help you find a home that allows you to keep all your other financial goals in balance.

Utilities

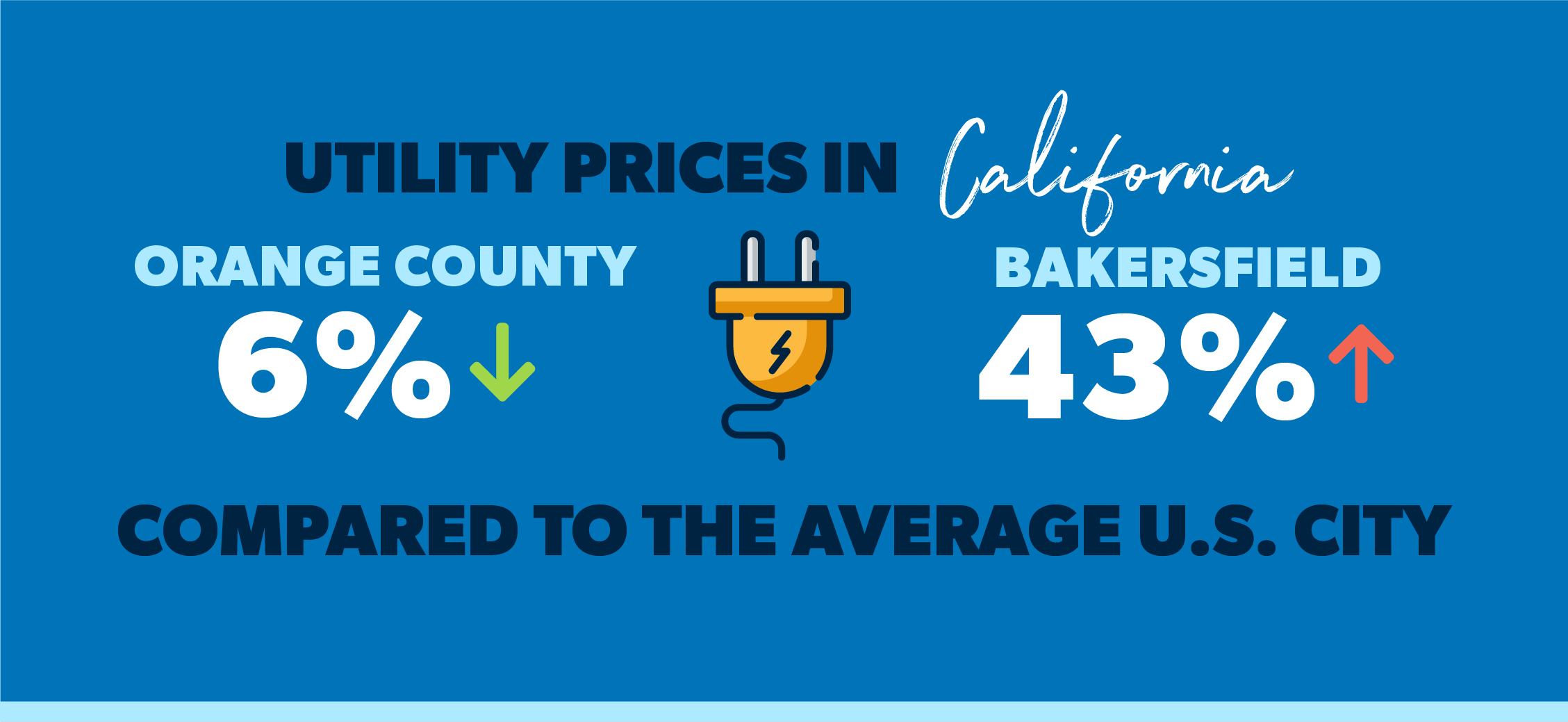

On average, Californians pay a little higher than most U.S. cities for utilities like energy and phone use. While Bakersfield might have cheaper housing, it has one of the highest utility costs in CA—nearly 43% higher than the national average.6

But again, there’s a wide range. Bakersfield pays 43% more for monthly energy than the national average. Orange County, on the other hand, has below-average utility costs—paying 6% less than the typical U.S. city.7 So don’t be afraid to crank up the AC!

Groceries

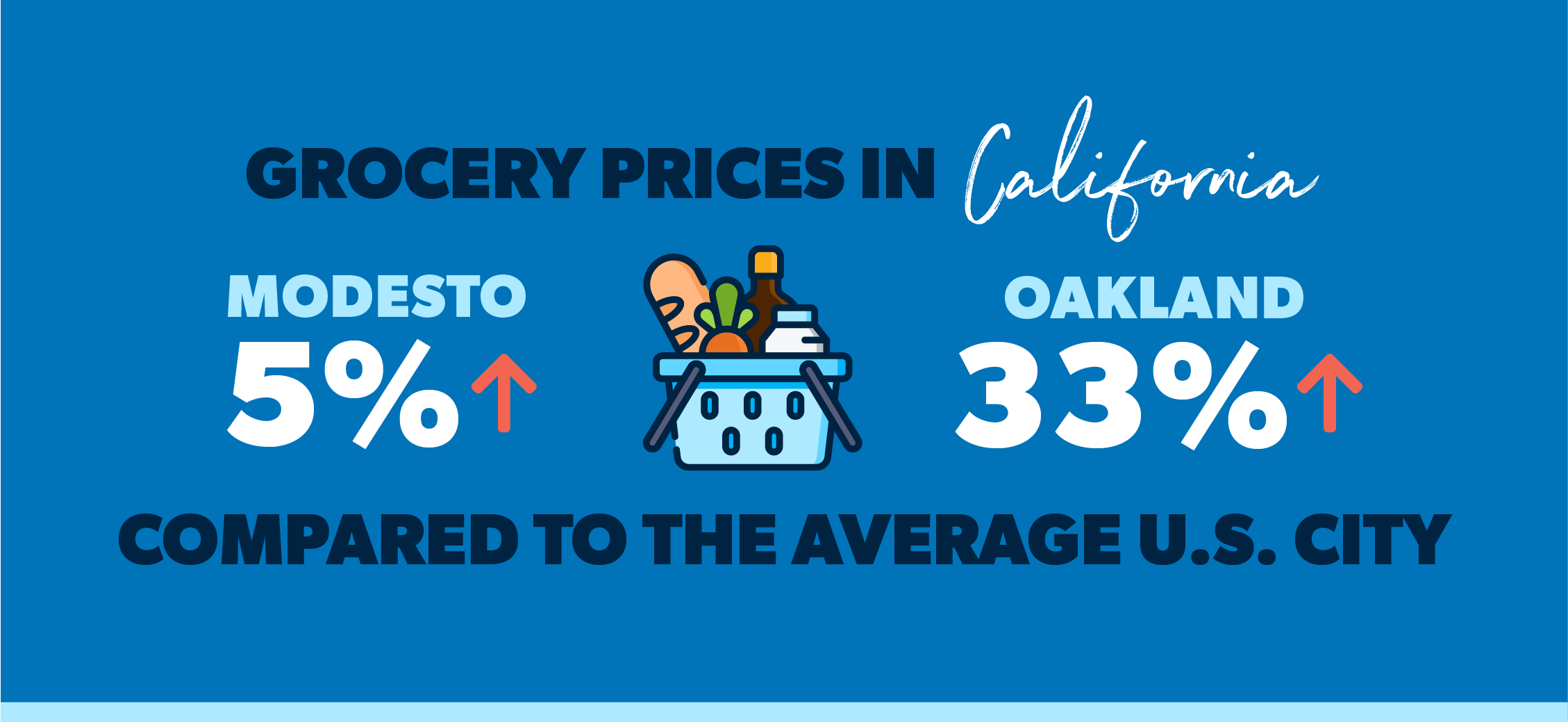

Get ready to start shopping at Safeway! The cost of groceries in California ranges between 5–33% higher than the average U.S. city.8 The City of Modesto has some of the least expensive groceries in CA, but expect to ring up higher totals at grocery stores in Oakland.

Sacramento, on the other hand, sits somewhere in the middle. The average cost of cereal and a half gallon of milk in Sacramento is nearly $7—a whole dollar more than the national average!9 So if you spill your milk in California, it’s okay to cry. Just let it out.

Transportation

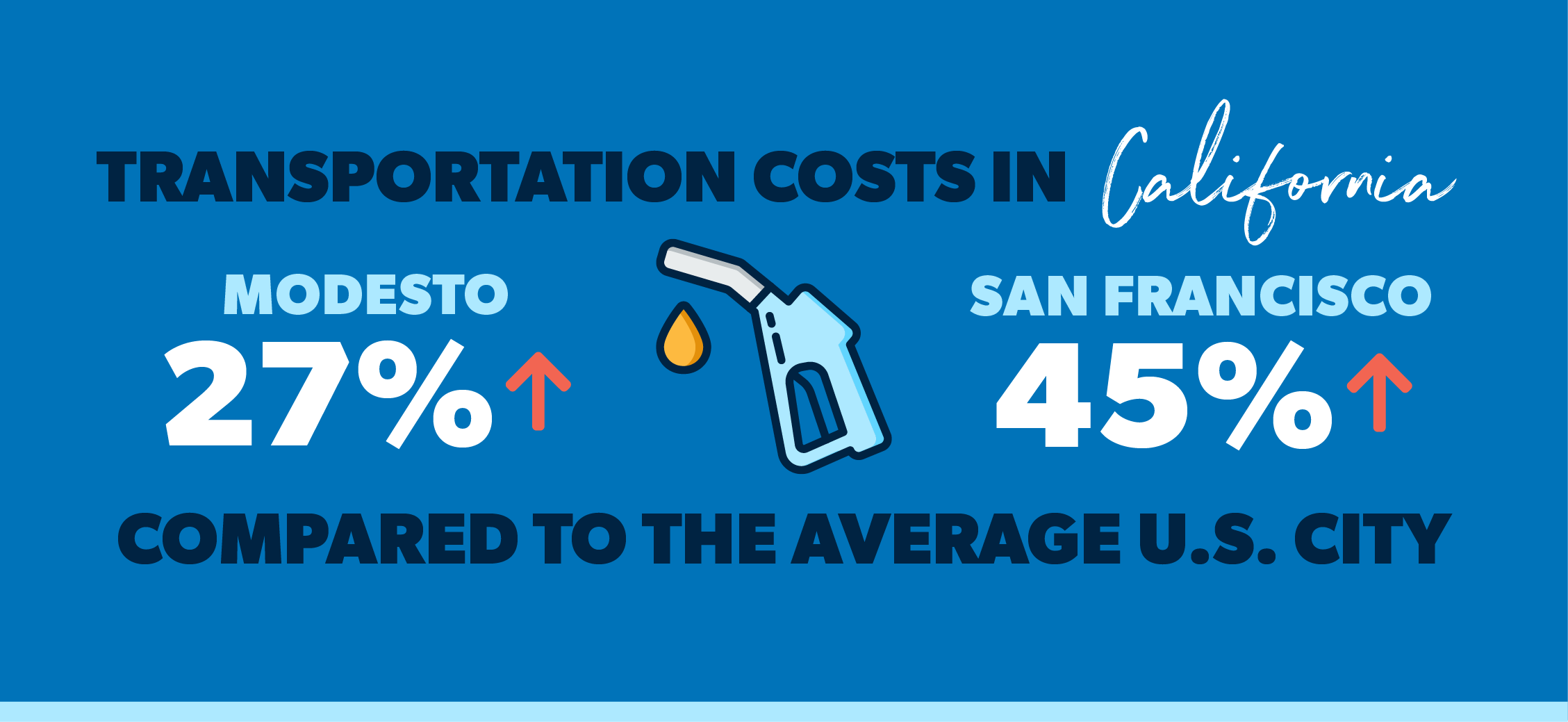

Take a deep breath—California has the highest transportation costs in the country. Costs like car maintenance and gas prices guzzle away 27–45% more of your money than anywhere else in the nation!

Even though Modesto has the lowest gas prices in California, their pumps still charge 27% more than the rest of the U.S. And—pump the breaks—San Francisco charges the highest gas prices in the nation at 45% higher!10

But don’t worry. There are still ways for you to save money on transportation costs in CA. Try bundling your auto insurance for a discount by talking to one of the independent insurance agents we recommend.

Health Care

San Francisco comes out on top again with the highest health care costs in California—30% higher than the average city in the nation. Meanwhile, Stockton ranks the least expensive among CA cities, which is only 2% more than the average U.S. city.11

Sacramento makes a comeback as the middle price range for health care costs in California. Check out how Sacramento compares to the average city in the country:

|

Health Care Type |

Sacramento, CA Cost |

Average U.S. City Cost |

Cost Difference |

|

General doctor |

$150 |

$115 |

30% |

|

Dentist |

$103 |

$98 |

6% |

|

Eye doctor |

$130 |

$106 |

22% |

|

Advil |

$10.14 |

$9.30 |

9% |

|

Prescription drug |

$480 |

$469 |

2%12 |

Taxes

If you’re wondering why California sounds pricier than most states, you might point the finger at taxes. The state has the highest income taxes in the country! They range all the way up to 13.3% for the highest tax bracket. On the other hand, Californians in the bottom bracket only pay 1% of their income to the state.13

The Golden State also has the highest state-level sales tax rate at 7.25%! But when you factor in their average local-level sales tax rate of 1.41%, CA drops to the ninth highest total sales tax rate in the nation.14 Still, in some cities, it might feel like California taxes you for breathing.

If all this tax talk makes your eyes glaze over, no worries. You can find out exactly how moving to California will impact your taxes by connecting with one of our trusted tax advisors. We only recommend tax pros who have the heart of a teacher.

Miscellaneous Goods and Services

Miscellaneous costs refer to a wide range of goods and services including things like common restaurant foods, clothing, entertainment, activities and personal care. In California, the cost of these goods and services range all the way from below 11% to above 33% of the national average!15

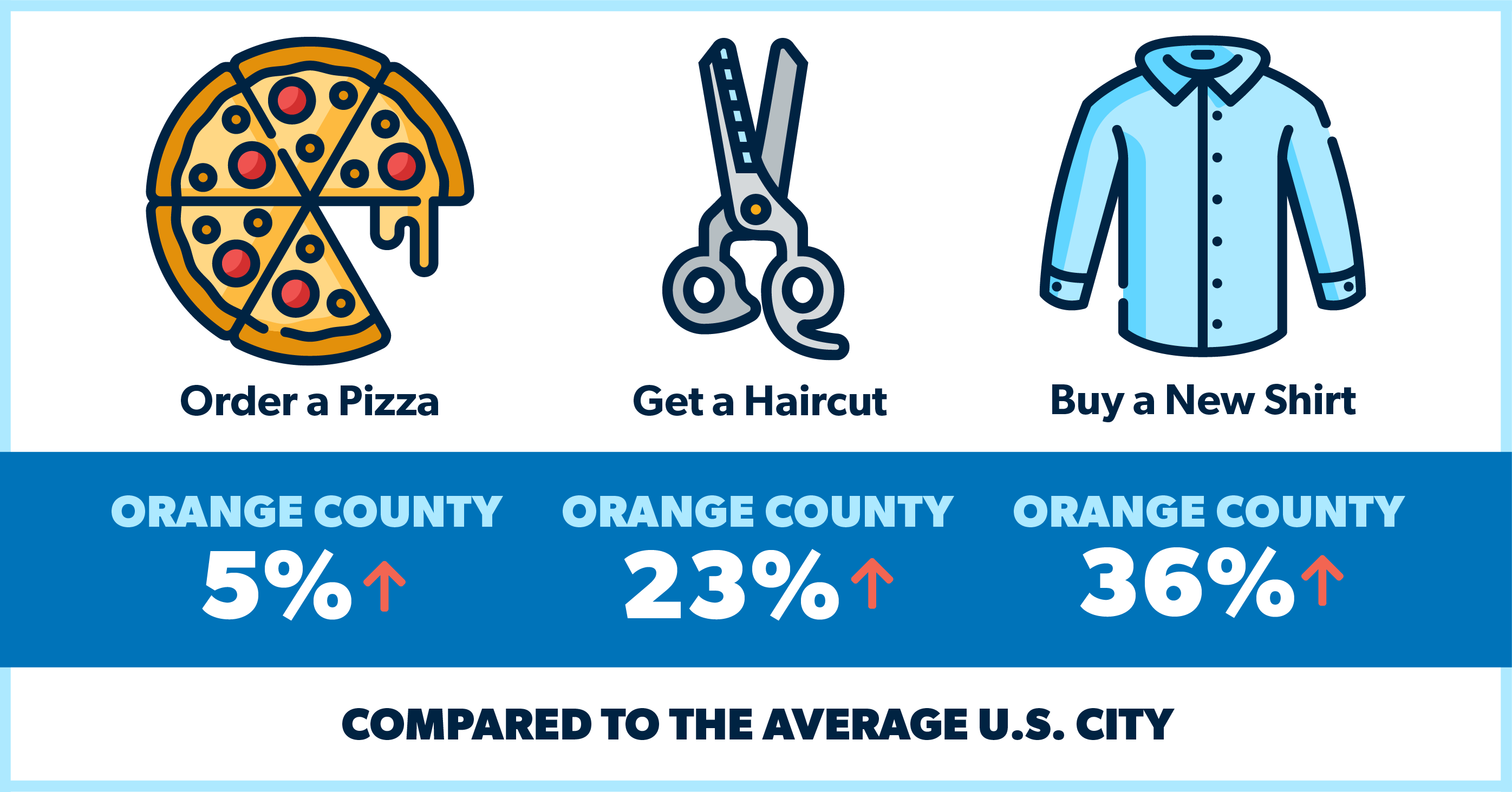

In Orange County, miscellaneous costs match the average of most California cities and rank 10% higher than the rest of the country. Style comes with a price in the OC—a haircut will cost you an average of 23% more compared to the rest of the country and your rad new shirt will be 36% more. But hey, you can order pizza for only about 5% more than the typical U.S. city in Orange County—and there’s Disneyland. 16

Compare the Cost of Living in California to Your Current City

Now you know the cost of living in California—but can you afford it? If you want to be sure, try our free Cost of Living Calculator to determine how much more or less expensive it would be for you to live in the CA city that’s calling your name.

If California has a higher cost of living than you can currently afford, not all hope is lost. Try one of these ideas:

- Adjust your standard of living.

- Try to bump up your salary when you find a new job.

- Move to an affordable zip code that’s within range of your desired city.

Ready to Move to California?

If you can afford living in the Golden State, congrats! The next step on your relocation journey is to handle your housing. For a quick and easy way to find real estate agents in CA and your current city, try our RamseyTrusted program. We only recommend the best-performing agents who are on a mission to help you crush your relocation goals.

Find a top-performing real estate agent!

Where Did We Get Our Data?

The data that drives most of these numbers and our Cost of Living Calculator comes from the Cost of Living Index published by the Council for Community and Economic Research (C2ER). Since the cost of living in any area is constantly changing, you can always check our calculator to find the most recent data. If you want to learn more about C2ER, get the scoop here.

Read the full article here