Balance transfer credit cards can be a valuable tool if you’re stuck paying off credit card debt with a high APR. After all, the right balance transfer card can help you consolidate and pay down debt with zero interest for a limited time, which could help you pay off debt more quickly and potentially save hundreds of dollars per month.

If you’re hoping to ditch debt and start working toward a better financial future, a Chase balance transfer credit card with an intro APR offer could be exactly what you need.

What you need to start a balance transfer with Chase

Whether you’re completing a balance transfer as part of applying for a new card or you’re taking advantage of an offer as an existing cardmember, you’ll need the following information to complete your transfer:

- Account number(s) for balance(s) you want to transfer

- Amount(s) you want to transfer

How to do a balance transfer with Chase

You can complete a balance transfer online or over the phone, and transferring a balance to a Chase card is fairly simple. In either case, remember there’s no guarantee your balance transfer request will be approved and don’t forget to account for the balance transfer fee. Bankrate’s balance transfer calculator can help you know what to expect.

How to transfer a balance to a new Chase card

If the card you’re applying for has a balance transfer offer, you’ll be asked whether you want to take advantage of it as part of the application process. Toward the bottom of the application page, you’ll see the option to “Add balance transfer,” which will open a screen requesting your account numbers and amounts you’d like to transfer.

EXPAND

- Add your balance transfer requests to your application. You’ll need to know the amounts and account numbers of the debts you want to transfer. You can transfer amounts from up to three cards.

- Complete your card application as usual. Finish filling out the requested information for your card application and submit it.

If your application is approved, you’ll receive a credit limit and other information just like you would with any new card application. The difference here is you may have to wait at least one week for Chase to approve your balance transfer. If your approved credit limit is less than the amount you requested to transfer, Chase will either decline the transfer request or approve a smaller amount for transfer.

If you don’t fill out the transfer request during your card application, you can still request one after you’ve been approved for the card. Don’t lose track of any introductory period limitations. For instance, if your card offers an intro balance transfer fee, you must typically transfer your balance within 60 days of account opening to qualify for it. After that, you may be subject to a higher balance transfer fee and no longer qualify for a 0 percent term.

How to transfer a balance to an existing Chase card

Existing Chase cardholders may also qualify for balance transfer offers. The offers likely won’t be for a 0 percent APR term, but could be lower than the APR on the card on which you’re carrying debt.

Here are the steps to complete a transfer to an existing card:

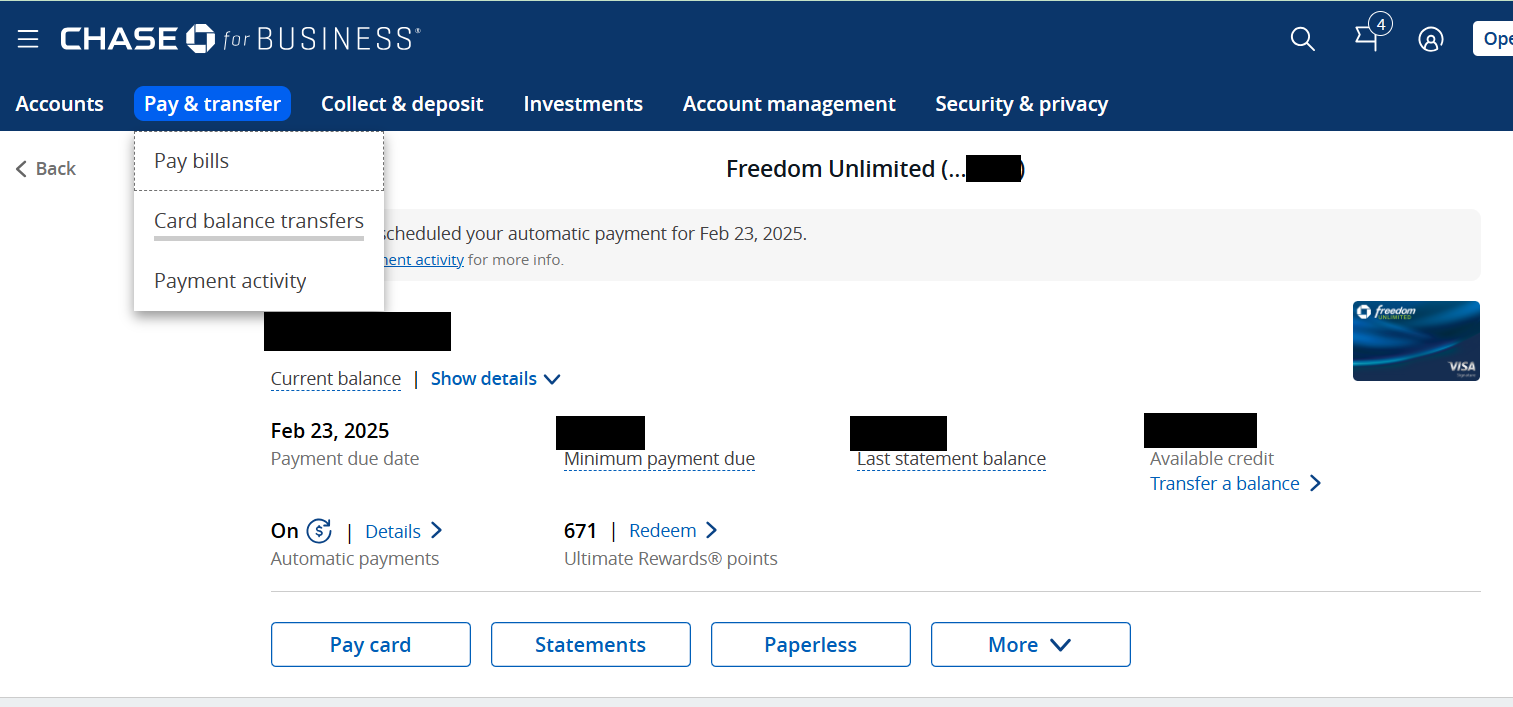

- Log in to your Chase account. You can do this online or via the mobile app and navigate to the “Pay & Transfer” menu and then “Card balance transfers.”

EXPAND

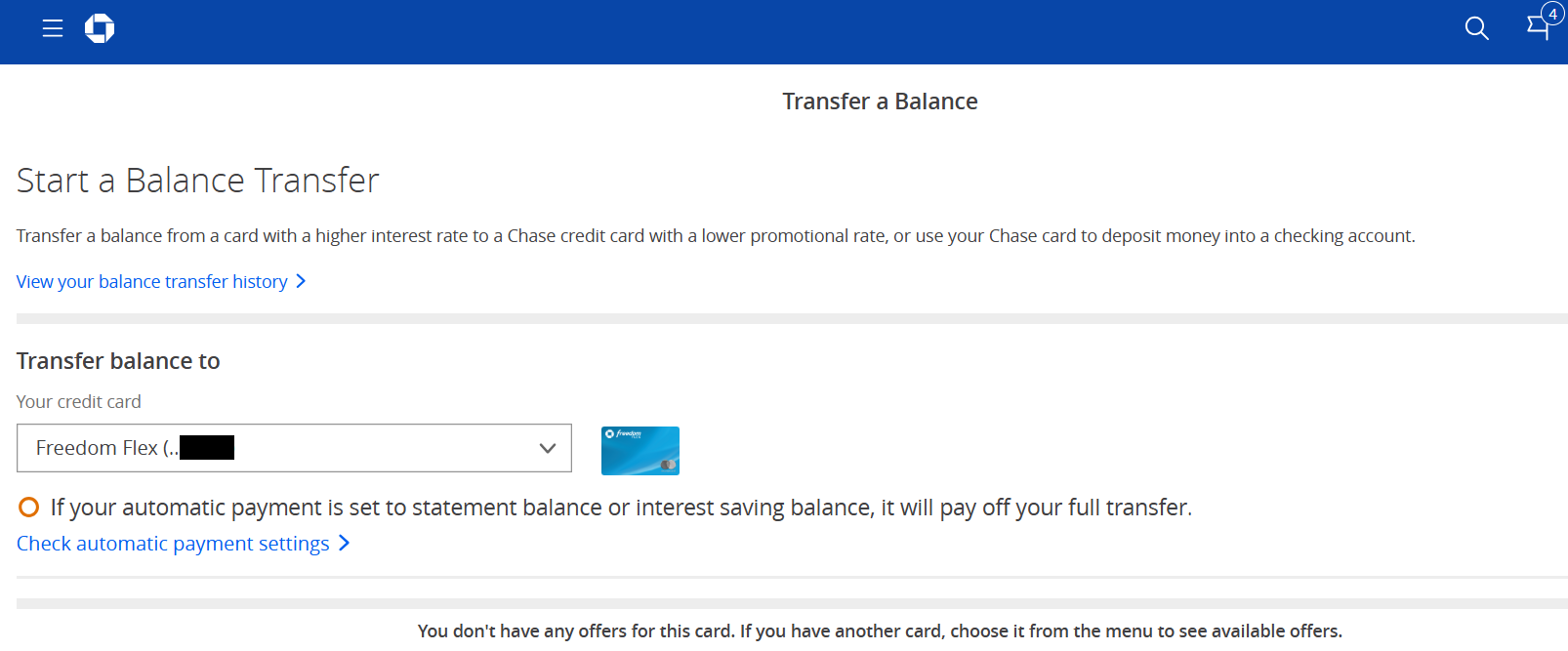

- Select the credit card and account that you want to transfer the balance over to. At this point, Chase will tell you whether your card is eligible to receive balance transfers at that time. Assuming you have a balance transfer option, continue to step 3.

EXPAND

- Enter the details of your transfer. These details include the account number of the credit card you want to move a balance from and the amount you want to transfer. Don’t forget to factor in the Chase balance transfer fee.

- Submit your balance transfer request. You’ll have to confirm you have read the terms and conditions and follow the prompts to initiate the transfer to your Chase credit card.

If you prefer to transfer balances with help from a customer service representative, call the number on the back of your credit card instead to get started.

What to know after requesting a balance transfer with Chase

You can log in to your Chase account to see whether the balance transfer has taken place. It can take up to 21 days for Chase to process your balance transfer, so make sure to give it some time. While you wait, continue making on-time payments to all your credit card accounts to avoid late fees and penalties.

After the balance is transferred to your Chase card, make sure to check your old account to confirm that the full amount of the transfer has taken place. If your old account still has a small balance and you don’t pay your bill, you could face late fees and damage your credit score.

The bottom line

If you want to consolidate high-interest credit card debt, transferring a balance to a Chase credit card with an intro APR offer could help you save on interest for a limited time and pay down your debt more quickly.

However, before choosing a balance transfer card, be sure to compare all the best balance transfer offers on the market today. Some cards offer much longer intro APR periods than others, and you may be able to find an intro offer for purchases, among other benefits.

Frequently asked questions (FAQs) for Chase balance transfers

Read the full article here