Did you know Americans spent $886.7 billion on Christmas last year?1 That’s a lot of photo cards, personalized stockings, candy canes, Christmas music, Santa hats and sparkly ornaments. But unless you plan on skipping Christmas this year, you’ll find yourself a part of that $886.7 billion machine too.

Good news: You can enjoy the gift-giving season without any guilt-ridden overspending. How? Set up your Christmas budget, save up a Christmas fund—and then stick to your plans.

How to Make a Budget

In the classic Christmas movie Home Alone, Kevin McCallister makes a plan for how he’s going to tackle the intruders in his house—a little glue here, some glass ornaments there, and a couple swinging paint cans for good measure.

What’s our point? Well, just like Kevin, you need a plan—and that’s what a budget is: a plan for your money (no swinging paint cans required). Now, to set up a Christmas budget, you also need to set up your monthly budget (which, by the way, is much easier with EveryDollar).

Here’s how to get started in three easy steps:

1. List your monthly income.

What counts as income? Any and all money your household brings in each month is income—including any side jobs you picked up for the holidays!

2. List your expenses.

Now it’s time to write down every expense you know is headed your way.

- Giving (this should be 10% of your income)

- Savings (depending on your Baby Step)

- Your Four Walls (food, utilities, shelter and transportation)

- Other essentials (insurance, debt, childcare, etc.)

- Extras (entertainment, restaurants, etc.)

Once you’ve got the regular expenses in the budget, add a Christmas budget category! Under that, you’ll need budget lines for gifts, decor and ingredients for all those delicious Christmas dishes you make every year.

P.S. We’ll talk more about this below in the How to Set Up Your Christmas Budget in EveryDollar section—so you can stay on budget (and out of debt) through the whole holly jolly season.

3. Subtract your expenses from your income to equal zero.

We believe in making a zero-based budget. That means every dollar needs a job! So, when you subtract your expenses from your income, that equals zero.

Why? Well, when you leave money lying around, it gets spent accidentally. That’ll get you on the naughty list with Santa and hold you back from making progress with your money goals.

What if you do the math and get a negative number? This can totally happen at the holidays with all those extra expenses in the budget. But listen, a negative number here means you’re planning to spend more than you make. That. Won’t. Work. Just cut some spending or increase your income to make the number zero and balance it all out!

What if you end up with more than zero? Celebrate! Then put that money to work by putting it toward your current Baby Step. (Or getting a better gift for your favorite relative. We won’t tell!)

And if you have an irregular income, don’t sweat it. You can still use zero-based budgeting. All year long! You just need to plan low and then adjust after you get paid. And heads up, we’ve got a new premium feature in EveryDollar called paycheck planning that was made for irregular incomers.

Take a guess at how much American families plan to spend on the holidays this year. According to our State of Personal Finance study, the answer is $1,300. We don’t know about your budget, but with inflation, well, drumming up an extra $1,300 isn’t easy.

Start budgeting with EveryDollar today!

So, before we go any further, hear this: You don’t have to spend that much. You have nothing to prove to anyone with your decorations, gifts and fancy food spread. That’s not the point of the holidays. It just isn’t. Free yourself from feeling pressured to spend any particular amount and focus on what you’re able to afford—and on living the true joys of the season!

With the next few steps, you’ll learn how to set a spending limit you can afford, set up everything inside your free EveryDollar budget, and then stick to your plan. Ready? Let’s do this.

1. Plan how much you’ll spend this year.

When you’re setting your spending limit, remember: The amount you should spend is based on what you make, what you’ve saved, and what you can move around in your budget to get the job done.

You’ve already set up your monthly budget, so you should have a good idea of how much you’ve got to play around with for Christmas this year. Set planned amounts for Christmas gifts, food, travel, decor and anything else.

And whatever you decide to spend, be ready to stick to it. Commit to no debt, because no one needs Christmas payments sticking around past St. Patrick’s Day.

2. Create a Christmas budget category in EveryDollar.

Here’s how:

- Sign in to your EveryDollar account on your desktop computer.

- Scroll down to the bottom, and you’ll see Add Group. This is how you add a new category. Name it anything you want: Santa’s Stash, Festive Finances, Merry Money, or the super straightforward name we’ve given here—Christmas Spending.

3. Make budget lines for gifts, food, decor and all things holiday.

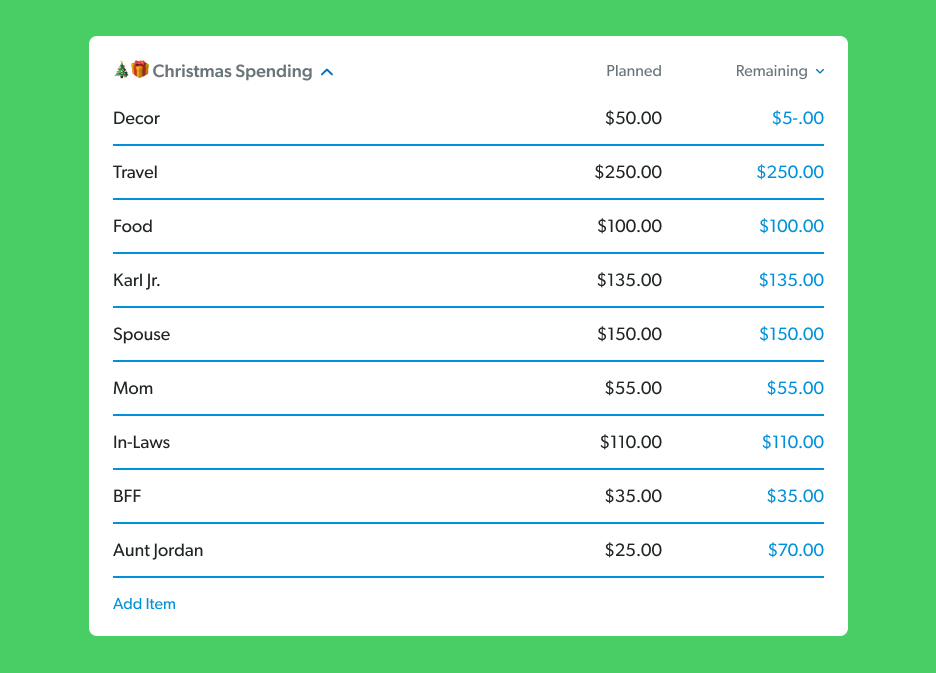

List everyone on your nice list and how much you plan to spend on each of them. This includes everyone from your kid to that coworker you got for Secret Santa this year. Just click Add Item and type in the name of each person.

At this point, every dollar you’ll spend is attached to someone’s name, just like categories in a normal budget. There’s a budget line for everyone—see how there’s a line for gifts for Mom? You can always start with our printable Christmas Present Planner. Just make sure you put everything in EveryDollar too!

And don’t forget to have lines for any other Christmas spending, like food and travel. Or just add more money to your grocery spending and transportation lines if you’d prefer. Whatever gets your budget ready for the extra expenses of the season!

At this point, your Christmas budget might look a little something like this:

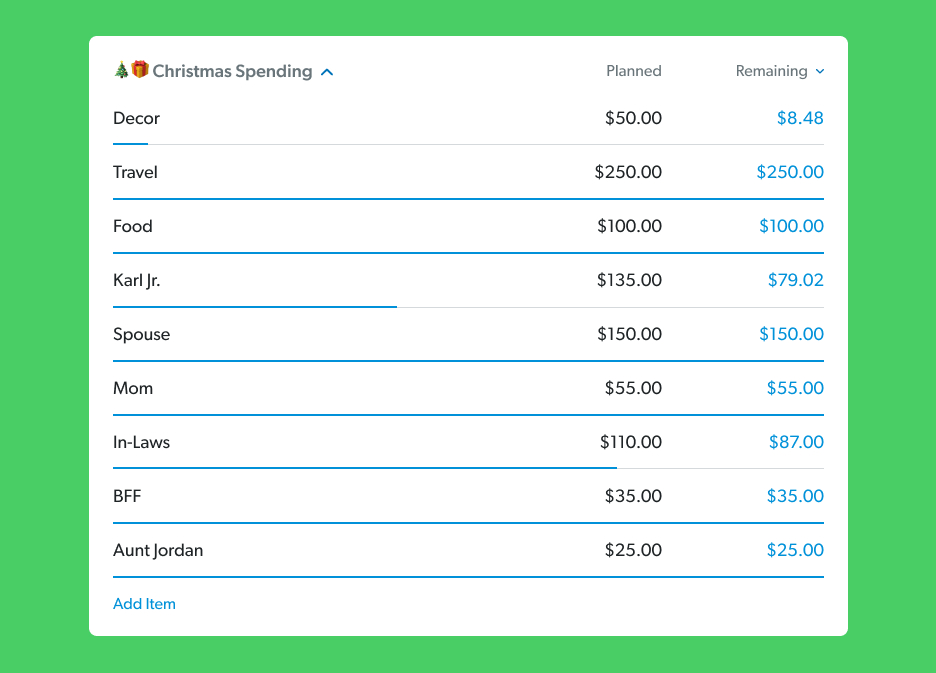

4. Track your spending as you go.

Want to know how you don’t overspend? You track your expenses. Every. Single. One. That’s right: Keep up with all that spending as you go. Log in to your budget, and click on the Transactions icon. Next, click the blue plus sign. Then, record the expense! (Or check out that premium version of EveryDollar, which includes bank connectivity so your transactions stream into your budget. Automatically. You just drag and drop them to the right line!)

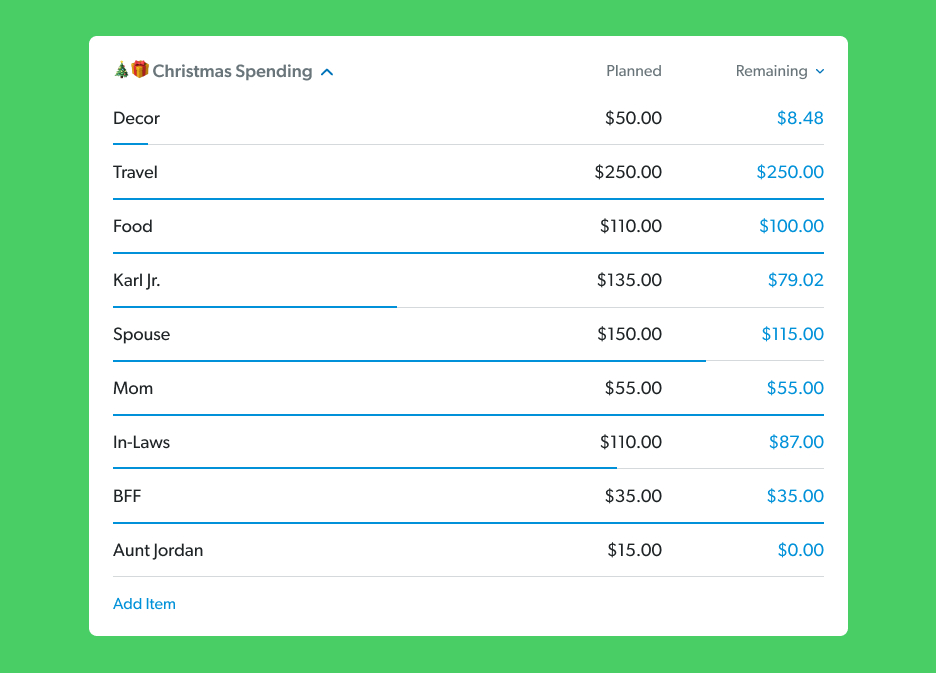

5. Move amounts around when needed.

If you budgeted $25 on gifts for Aunt Jordan but hit a few sales and got everything you need for only $15, then take that extra $10 and put it to good use. You can buy Aunt Jordan another gift or add that amount to another budget line where you might need a little more wiggle room—like your 6-year-old’s Christmas list that seems to get longer and longer. By. The. Minute.

That’s the beauty of your Christmas budget—this thing’s not set in stone. You can change up the planned amounts after you put them in there. Just make sure you don’t overspend the total amount you planned for Christmas—or your budget as a whole!

Save Money Through the Year With a Christmas Fund

We’ve talked a lot about your Christmas budget, but now it’s time to talk about a Christmas fund (yep—they’re two different things). Think of a Christmas fund like a savings account you set up for all your Christmas needs. This is where you’ll stash the money you’re saving for Christmas and watch it grow as the season gets closer.

If you’re reading this in November or December, you don’t have time to create a sinking fund . . . for this year. But keep reading, because you’ll want to start saving next summer so you aren’t scrambling to cover Christmas next year.

When you’re planning a Christmas fund goal for the year, take a look at how much you spent on Christmas gifts last year. Where did you overspend? Do you need to up your budget or lower it a smidge? Where can you cut back this year?

Answer those questions, then set up a Christmas fund! How? Good question. Let’s answer that next.

How to Set Up a Christmas Fund

How’s how you create a Christmas fund:

- Set a total goal amount for your Christmas fund.

- Divide that total by the number of months before Christmas. This is how much you need to save each month.

- Create a sinking fund in EveryDollar (with the steps below) to stash that amount back every month to reach your goal.

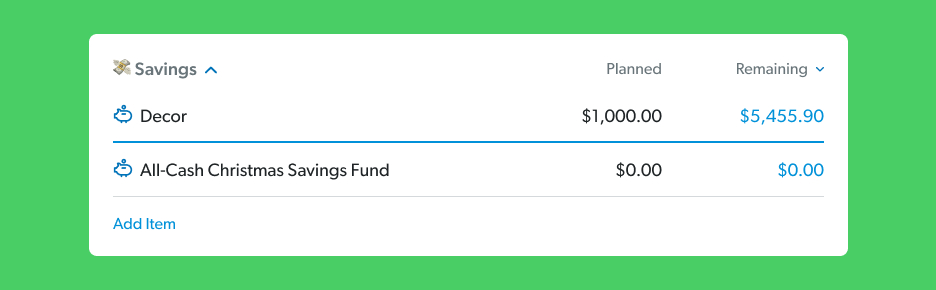

- Log in to EveryDollar.

- Under Savings, click Add Item.

- Name your budget line.

- Tap the new line to open it up.

- Click Fund, and then Make This a Fund.

- Now you can start entering how much you’ve saved so far, the amount you plan to save each month, and your full Christmas savings goal!

EveryDollar will track how much you’re saving and how much more you need to save to meet your goal. In December, your Christmas savings will be fully funded, and you can savor the season instead of feeling pinched for extra money.

That’s your PSA to budget early for next Christmas! Seriously. If you save little by little, month by month, coming up with Christmas money won’t hit you like the reindeer that ran over grandma in that crazy song.

How Do You Get the Cash for Christmas?

Okay, you’ve got that budget set, and you know you need to find extra cash for Christmas this year. How can you make it happen? Ask yourself these four questions:

What Budget Lines Can You Tweak?

Little splurges here and there, tickets to concerts or movies, that habit of clicking “add to cart” after a targeted ad—look through your normal budget and figure out what you can trim down for a month (or two) to free up money for your Christmas budget.

Don’t know where to start? Try buying generic at the grocery store, using coupon apps, meal planning, drinking homemade coffee, or carpooling to work. Don’t forget scaling back on things like restaurants, clothing, personal spending, gourmet hot cocoa and entertainment too.

Now, we already know what you’re thinking: But if I trim back on entertainment, my family can’t go see the Christmas lights this year! Oh, heck yes, they can. Drive to a neighborhood that goes all out and enjoy that free experience. BYOHC (bring your own hot cocoa) and make a cheap—but valuable—memory.

How Can You Boost Your Income?

We mentioned it earlier, but if you need some more money to hit your Christmas budget goal, get out there and increase your income.

You could sell baked goods, take on extra hours at work, or even start a side hustle. Make some money quick by selling things online, try cashing out rewards from money-making apps.

Get creative: Babysit so parents can go Christmas shopping alone, shovel driveways and sidewalks full of snow, offer gift-wrapping services . . . Even the sky isn’t the limit for Santa, or for you.

What Christmas Traditions Can You Skip?

Psst, guess what? You don’t have to do elaborate pranks with your Elf on the Shelf this year. Or fancy Christmas card photo sessions. Or a Clark Griswold-style Christmas lights display. The kids will survive, we promise.

You can save money this year by cutting out traditions that you don’t truly have to do. Be open and honest about your budget as you try to figure out which traditions to cut and which to keep.

How Can You Cut Down on the Cost of Gifts?

Shop sales. Use coupons. Go for DIY homemade gifts instead of buying gifts at the store. Give out baked goods for gifts. Skip all the random gift exchanges. Instead of presents for every extended family member, just draw names and buy only one gift for the person you get.

So, breathe a big sigh of relief. You can spend less on presents this year—without being a Grinch.

Will Making a Christmas Budget Really Save Money?

Yes! You’ll find your Christmas shopping experience is much merrier and brighter when you can check everyone off while sticking to your budget, instead of spending first and worrying about the fallout later.

Having a budget is the quickest way to make your money goals a reality. Saving for Christmas? You should budget. Trying to get out of debt? You should budget. Saving for retirement? You should budget. Already a millionaire? Guess what—you should still budget.

Saving money for Christmas with your budget doesn’t have to be complicated. With our free budgeting tool, EveryDollar, you can create Christmas funds and track gift buying for everyone on your list.

Follow these steps to set up your budget so you can have a holly jolly, well-budgeted, debt-free Christmas and a happy new year.

Read the full article here