Most consumers may think that the Federal Reserve’s rate moves determine deposit interest rates. While they certainly influence them, did you know there’s another factor – one that can cause banks to pay two or three times more for deposits than competitors as the Fed lowers rates?

You read that right. Lower Fed rates may sustain deposit rates where they are, or cause some offerings to edge even higher. Here’s why.

Fed rates ≠ deposit rates

When the Fed lowered its target rate by half a percentage point, or 50 basis points, in September, banks and credit unions across the country took that opportunity to lower the rates on their checking and deposit accounts – savings, money markets, and certificates of deposit (CDs). Most people followed that seemingly unified rate drop, but many don’t know that banking institutions’ pricing varies widely.A recent example is disclosed interest rates from 6,688 financial institutions in October, not long after the Fed’s Sept. 18 rate drop. More than half (51 percent) of banks and credit unions reporting rates to Standard & Poor’s had a maximum disclosed rate below 4 percent, according to fintech firm The CorePoint. One-third (33 percent) had a disclosed maximum rate below 3 percent. About 20 percent had a maximum disclosed rate below 2 percent. Just looking at disclosed rates – not negotiated or promoted rates – the top 51 percent pays as much as three times more for deposits than the lowest 20 percent.

Source: Analysis by The CorePoint of S&P Data, September 2024 Disclosed Rates

How could there be so much variation if the Fed’s rate changes determine savings interest rates?

The variation comes from a few factors, but bank and credit union lending is the primary one. Industry insiders follow banking’s loan-to-deposit ratio to track the volume of loans relative to the volume of deposits needed to fund those loans. Fewer loans – and other earning assets such as bonds – also means less revenue to pay interest to depositors. If fewer people use credit (banking’s product), institutions have a lower need for funding from deposits (banking’s raw material).

If you look at individual institutions, some have incredibly high interest income relative to peers and high loan ratios. This is how outliers are made in deposit pricing. It may also translate to even wider variations in deposit pricing in the year ahead. Some institutions will simply have more pressure to pay for deposits.

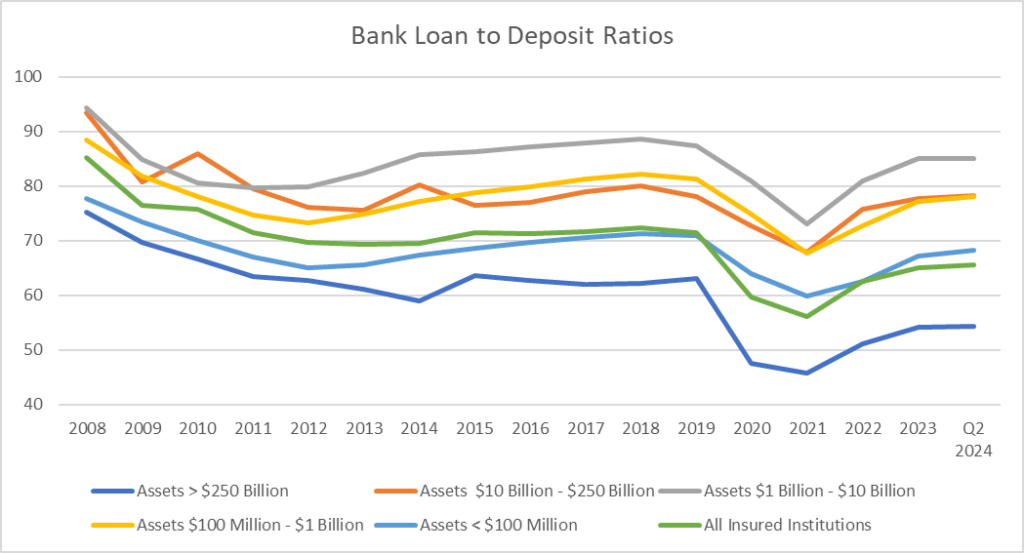

How low are banks’ loan-to-deposit ratios?

So, just how low are banking’s loan-to-deposit ratios? And what is a “high” loan-to-deposit ratio?

Bank loan-to-deposit ratios have been trending downward for the past 15 years. The anomaly was the pandemic, during which lending screeched to a halt and then recovered.The industry now sits at just over 64 percent loans to deposits, according to the latest data from the Federal Deposit Insurance Corp. (FDIC) in the second quarter. That’s down from this century’s high point of 91.6 percent in the second quarter of 2008. Banking institutions have tremendous capacity to lend from a historical perspective.

Source: Analysis by The CorePoint of FDIC Data, September 2024

Can you imagine what deposit rates would have been if loan demand had been higher when the Federal Reserve raised rates? The 6 percent highs in deposit rates of early 2024 may not have been so extraordinary. Rates above 5 percent are probably off the table in the near future. But we’re also probably not returning to the near-zero rate environment of 2022.

It’s likely to remain worth your while to manage your savings actively for the foreseeable future. And finding outliers can pay.

Loan and deposit pricing are tied together

Your conversations with friends and relatives probably paint a pretty clear picture of today’s pent-up loan demand among everyday people and businesses.

Most people have connections waiting to start a business, remodel a kitchen, buy a car, or refinance their home because their payment would be too high in the current rate environment. An even more significant impact on lending for banking is commercial businesses. Executives have been holding off on borrowing because of the recent 15-year highs for loan rates. As loan rates come down, more borrowers will come back into the market for credit. As the demand for credit builds, banking’s loan-to-deposit ratio will also rise, and their deposit rates commonly follow suit.

Actively managing your savings account or shopping around for an account with a better rate, will not only be wise but it may pay two- or three-times higher returns on your deposits. Free sources, such as the FDIC’s BankFind Suite, can be used to find institutions with high demand for deposits and engage those institutions that have seen more growth. They will have more specials and greater interest in negotiating pricing, and you will have more power to obtain higher rates of return.

Read the full article here