Apple is one of the most valuable companies in the world and has consistently rewarded investors with strong returns over the past two decades. Its simply designed and innovative products have been highly sought after by consumers for years, and the iPhone, iPad, AirPods and Apple Watch have transformed the categories they compete in.

In 2018, Apple became the first publicly traded company to surpass $1 trillion in market value, and is worth $3.4 trillion as of September 2024. The company’s products are synonymous with luxury in the tech industry and have become so intertwined in people’s lives that many can’t live without them.

Here’s what else you should know about investing in Apple (AAPL) and how to buy shares in the tech giant.

Investing in Apple stock: How to buy shares

1. Analyze Apple and its financials

Analyzing a company’s competitive position and financials is probably the single hardest part of buying the stock, but it’s also the most important. The best place to begin is with the company’s Form 10-K, which is the annual report that all publicly traded companies must file with the SEC.

The 10-K can help you understand a lot about the company:

- how it makes money and how much

- its assets and liabilities

- its profitability trends over time

- the competitive landscape

- the various risks faced by the business

The annual report is a great first step at finding out about the company, but you’ll want to do more than this. You’ll want to study what other businesses are doing to compete, because it’s important to have a broader perspective on the industry.

For example, Apple competes with the largest companies in the world, all of which have deep financial resources and can attract the smartest employees. Rivals include Microsoft, Google and Meta Platforms (Facebook), and they battle for market share across various domains, such as smartphones, communication apps and virtual reality headsets. Each company has its own agenda in the tech world, and that does not always coincide with how Apple is strategizing.

2. Does Apple make sense in your portfolio?

Apple has been a fantastic performer for many years, and in 2023 the company earned nearly $100 billion. But you’ll need to keep an eye on this growth stock, because the tech world is all about disrupting the established players such as Apple. While legendary investor Warren Buffett’s company, Berkshire Hathaway, owns millions of shares in the stock, that may not mean it’s right for you. Apple does pay shareholders a quarterly dividend, making it more attractive for certain investors who want to earn passive income.

So you’ll want to consider the following questions:

- Do you understand the business and its future prospects?

- Will you be able to continue analyzing the company and industry as it grows?

- Given that stocks can be volatile, will you be able to hold on if it drops, or even buy more?

- Do you have a sense of what the company is worth and how that compares to the current market value?

- Apple pays a dividend — does that fit your needs?

3. How much can you afford to invest?

How much you can afford to invest has less to do with Apple than with your own personal financial situation. Stocks can be volatile. So, to give your investment time to work out, you’ll likely want to be able to leave the money in the stock for at least three-to-five years. That means you should be able to live without the money for at least that length of time.

Committing to holding the stock for three-to-five years is important. You’d hate to have to sell the stock when it’s near a low only to watch it rebound much higher after you exited the position. By sticking to a long-term plan, you’ll be able to ride out the ups and downs of the stock.

If you’re investing in individual stocks, you’ll likely want to keep the percentage of any single position between 3 and 5 percent. This way you’re not heavily exposed to one investment breaking your portfolio. If the stock has more business risk, then you might choose an even lower percentage than this range.

In addition, rather than just committing a one-time sum of money to the stock, consider how you can add money to your position over time.

4. Open a brokerage account

While opening a brokerage account may sound like a difficult step, it’s actually quite easy, and you can have everything set up in 15 minutes or so.

You’ll want to select a broker that caters to your needs. Are you trading often or infrequently? Do you need a high level of service or research? Is cost the most important factor for you? If you’re buying a few stocks but investing mainly in funds, then a number of brokers specialize in offering commission-free trading for those funds.

(Here’s Bankrate’s list of best brokers for beginners.)

After you’ve opened your account, you’ll want to fund it with enough money to buy Apple stock. But you can take care of this step completely online, and it’s simple.

With Apple shares trading around $220 per share as of September 2024, you may not have enough money to buy an entire share. Several brokers, including Charles Schwab and Fidelity, have started offering fractional shares to help with this problem, allowing you to invest with just a few dollars.

5. Buy Apple stock

Once you’ve decided to buy Apple stock and you’ve opened and funded your brokerage account, you can set up your order. Use the company’s ticker symbol — AAPL — when you input your order.

Most brokers have a “trade ticket” at the bottom of each page, so you can enter your order. On the broker’s order form, you’ll input the symbol and how many shares you can afford, or the amount you’d like to invest if you’re buying fractional shares. Then you’ll enter the order type: market or limit. A market order will buy the stock at whatever the current price is, while the limit order will execute only if the stock reaches the price that you specify.

If you’re buying just a few shares, then you’re likely best off sticking with a market order. Even if you pay a little bit more now for a market order, it won’t affect the long-term performance much if the stock continues to perform well.

Investing in Apple by the numbers

- Apple is the most valuable company in the S&P 500 as of September 2024 and has a market value of about $3.4 trillion.

- Apple earned more than $114 billion in operating income and $6.13 in diluted earnings per share during its 2023 fiscal year.

- The iPhone is Apple’s best-selling product, generating more than $200 billion in revenue and accounting for more than 52 percent of overall sales in 2023.

- Apple has split its stock five times since going public, with the most recent split being on a 4-for-1 basis on Aug. 28, 2020.

Apple’s recent developments

- Sept. 9, 2024: Apple announces new iPhones, Watches and AirPods. The iPhones are the first to include Apple Intelligence, which offers AI features to users.

- Aug. 5, 2024: A U.S. federal judge ruled that Google illegally maintained its monopoly in online search by making billions of dollars in annual payments to Apple in order to be the default search engine used on the iPhone and in the Safari browser.

- Aug. 3, 2024: One of Apple’s largest investors, Warren Buffett’s Berkshire Hathaway, disclosed that it had sold roughly half of its stake in the company.

- March 21, 2024: The U.S. Justice Department sues Apple, accusing the company of monopolizing the U.S. smartphone market by making it difficult for competitors to integrate with the iPhone.

Apple FAQs

- How profitable is Apple? In its fiscal year ending Sept. 30, 2023, Apple earned more than $114 billion in operating income and diluted earnings per share of $6.13.

- Who are Apple’s largest shareholders? The tech titan’s largest shareholders as of June 30, 2024 are The Vanguard Group, BlackRock and State Street. The three firms hold nearly 20 percent of Apple’s outstanding shares, according to SEC filings.

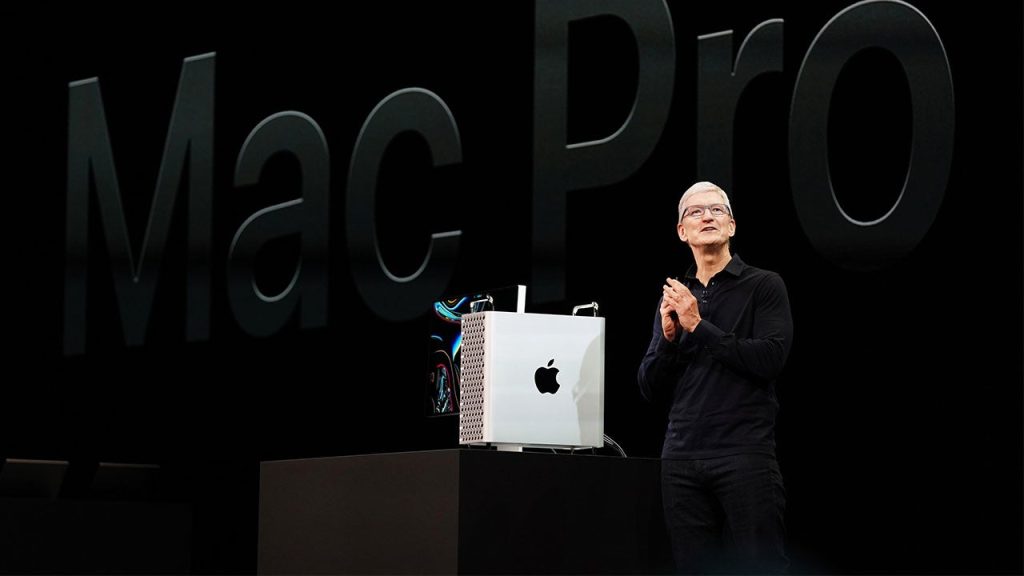

- Who is Apple’s CEO? Tim Cook was named CEO in August 2011 after Steve Jobs resigned due to health reasons. Prior to taking over as CEO, Cook served as Apple’s chief operating officer and was responsible for its worldwide sales and operations.

- How many shares of Apple stock are there? As of June 29, 2024, Apple had 15.3 billion shares outstanding, or 15.4 billion diluted shares, which account for things such as stock options.

- Does Apple pay a dividend? Yes, Apple pays a regular cash dividend of $0.25 per share each quarter, which may be increased over time.

- What were Apple’s sales in 2023? In its most recent fiscal year, Apple generated $383.3 billion in net sales. The company is expected to generate $390.3 billion in sales in its fiscal year ending September 2024.

- Who is Apple’s biggest competitor? Apple faces competition from a number of companies in categories such as smartphones, personal computers, tablets and more. Google, Microsoft, Samsung and Amazon would all be considered major competitors to Apple.

Bottom line

Buying a stock can be exciting, but success won’t happen overnight. Investors should take a long-term perspective on their investments, and they should consider taking advantage of dollar-cost averaging if they believe in the stock for the long haul.

With dollar-cost averaging, investors add a set amount of money to their position over time, and that really helps when a stock declines, allowing them to purchase more shares. High-flying stocks can dip from time to time, so the strategy can help you achieve a lower buy price and higher overall profits.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Read the full article here