Artificial intelligence giant Nvidia released its latest second quarter earnings report on Wednesday, which beat analysts’ estimates as the company’s AI-driven momentum continued.

Wall Street expected Nvidia’s earnings per share to come in at $0.64, up 137.5% from last year, while its revenue was estimated to be $28.7 billion, up 112.5% from last year, according to LSEG data. Its earnings per share came in at $0.68, while revenue was $30.04 billion.

Nvidia’s data center revenue, its largest operating segment, was projected to rise by 144% from last year to $25.15 billion. The company beat estimates and brought in $26.27 billion in sales from the segment — an increase of 16% from the prior quarter and 154% from a year ago.

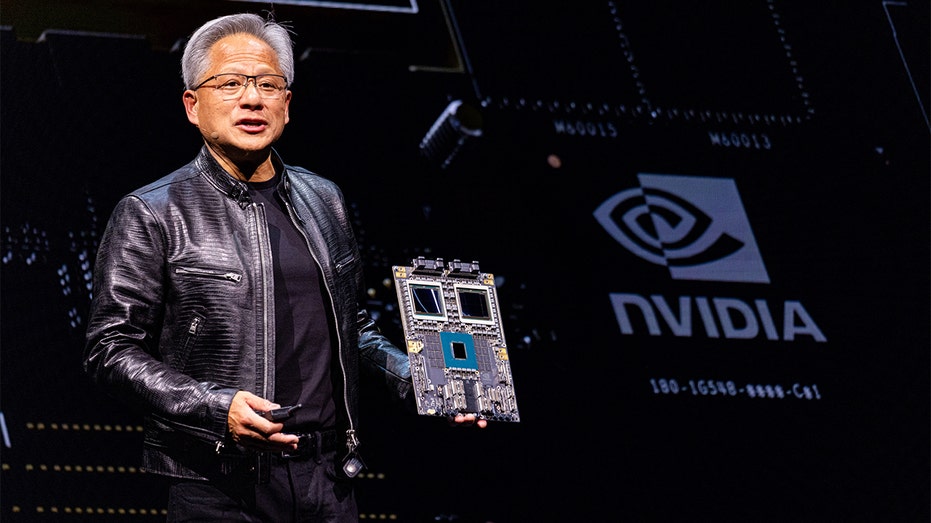

“Hopper demand remains strong, and the anticipation for Blackwell is incredible,” Nvidia founder and CEO Jensen Huang said of the company’s core chip offering and its next-generation product, respectively.

AI GIANT NVIDIA FACES CALLS FROM PROGRESSIVE GROUPS FOR AN ANTITRUST PROBE

“Nvidia achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI,” Huang added.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 125.61 | -2.69 | -2.10% |

Analysts had cited some concerns about production delays with the Blackwell AI chips that could push back deliveries and impact its revenues in the next few quarters. Huang said in the company’s release that it has started sending out Blackwell samples, but didn’t offer a timeline related to its anticipated 2025 ramp up.

HOW NVIDIA BECAME THE KING CHIPMAKER, FROM A DENNY’S TO $2.3T MARKET CAP

“Blackwell samples are shipping to our partners and customers. Spectrum-X Ethernet for AI and Nvidia AI Enterprise software are two new product categories achieving significant scale, demonstrating that Nvidia is a full-stack and data center-scale platform,” Huang said.

“Across the entire stack and ecosystem we are helping frontier model makers to consumer internet services, and now enterprises. Generative AI will revolutionize every industry.”

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

The options market had priced in a 9.8% up or down move in shares of Nvidia for Thursday in reaction to the results — a swing of more than $300 billion given its market capitalization of about $3.11 trillion.

Nvidia’s stock closed down 2.1% during Wednesday’s trading session, which left the chip giant’s stock up over 160% in 2024 to date. Its closing price of $125.61 was 7.4% below its record close on June 18.

In after-hours trading, Nvidia’s stock dipped to as low as $116.29 before paring back some of the decline to trade around $120 in advance of the earnings call.

Nvidia also issued a forecast for third quarter revenue that came in above Wall Street estimates, projecting revenue of $32.5 billion, plus or minus 2%, for the third quarter. That’s above analysts’ average estimate of $31.77 billion, according to LSEG data.

Reuters contributed to this report.

Read the full article here