While one part of his firm was advising on asset sales, traders at Mike Novogratz’s Galaxy Digital bought a hoard of Solana tokens at a steep discount from bankrupt crypto exchange FTX. Windfall profits are likely.

By Nina Bambysheva, Forbes Staff

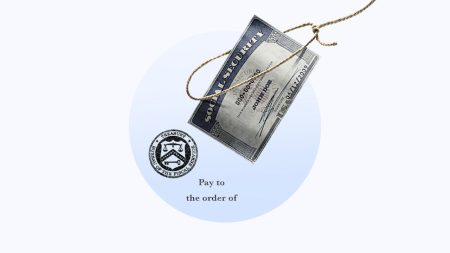

When FTX filed for bankruptcy, savvy crypto traders smelled a lucrative opportunity. Sam Bankman-Fried’s crypto empire was seemingly missing billions of dollars worth of customers’ funds but held $3.4 billion in various cryptocurrencies that the estate would have to sell to satisfy creditors’ claims, likely at hefty discounts to their trading prices.

Most of those in charge of the bankruptcy had little experience with crypto so early attempts to consolidate the funds sometimes resulted in embarrassing losses worth tens of thousands of dollars. In September 2023, the bankruptcy estate tapped the asset management arm of billionaire Michael Novogratz’s Galaxy Digital Holdings to help manage its vast crypto pile. This included selling, hedging, and staking the digital tokens—a process that allows token holders to earn passive income in exchange for helping to validate transactions added to a blockchain network.

Roughly a third of FTX’s crypto trove was held in SOL, the native token of the Solana blockchain, which Bankman-Fried championed. Between August 2020 and May 2021, Bankman-Fried’s companies bought close to 60 million of mostly locked SOL, according to the Solana Foundation. In late August 2023, the cryptocurrency was trading at around $20 per token, but by year’s end, its price increased five-fold, surpassing $100. It seemed like if FTX could quickly cash out its SOL and other assets, it would be able to satisfy the claims of its customers in full, at least in their dollar value as of the petition date—something creditors rarely achieve in major bankruptcies.

The caveat is that most of the tokens Bankman-Fried owned are locked, meaning they can only be sold in batches on a monthly basis between 2025 and 2028. Multi-year vesting schedules like this typically mean that tokens have to be auctioned at steep discounts to compensate for the considerable risk buyers assume due to crypto’s volatility. However, the potential returns could be enormous. Enter Galaxy’s trading unit, which positioned itself on the buying end of the auction.

In the fall of 2023, the debtors faced a challenging task. Offloading billions worth of SOL quickly would destabilize an already volatile market that was just starting to recover from the havoc FTX’s collapse caused, so taking advice from Galaxy Asset Management, it opted to spread the sale across multiple auctions.

The first batch—between 25 million and 30 million— sold in late March at a price $64 apiece representing more than a 60% discount to SOL’s price at the time. The auctioned tokens were purchased by a small circle of firms including hedge funds Pantera Capital and Neptune Digital Assets.

Previously undisclosed buyers also included Brevan Howard Digital, venture firm Multicoin Capital and the Solana Foundation, according to a source familiar with the deal. The Solana Foundation is a Zug, Switzerland-based non-profit initially set up by developers who created the blockchain that is dedicated to the growth and security of the Solana network. All declined or did not return Forbes’ request for comment.

But Novogratz’s Galaxy was also among the first auction buyers of FTX’s locked SOL. Galaxy Trading bought tokens on behalf of investors for a special-purpose fund that raised about $620 million and charged a 1% management fee, according to Bloomberg. Assuming Galaxy’s fund paid the discounted price of $64 per SOL, it ended up with 9,687,500 SOL tokens. Pantera, which also participated in the bid, had created a similar fund to buy up to $250 million worth of SOL. At current prices, Galaxy’s fund’s presumed 9.7 million token purchase would already be sitting on a $1.03 billion paper profit.

During the second auction, held in late April, the FTX estate reportedly offloaded 1.8 million SOL, with successful bids ranging from $95-$110 per token (at 15% to 26% markdowns from market prices). Galaxy Trading again raised money from investors for this auction, capping the minimum commitment at $5 million, according to The Block. Pantera also participated. The last batch of SOL sales wrapped up on May 22, drawing Pantera and the newly established crypto exchange Figure Markets. Figure scooped up 800,000 tokens at $102 a piece at roughly a 42% discount from the token’s recent price of $177. Total potential profits for the second auction? More than $130 million, based on current prices.

When details of the first auction surfaced, numerous FTX creditors as well as other bidders were taken aback. “It just looks very bad when both the buy side and the sell side of your house participate in the same transaction,” says one source with knowledge of the sales who requested anonymity.

“It’s not unheard of, or even that uncommon, for an investment bank to participate in multiple parts of a sale or liquidation event, like what happened here,” says Rob Hadick, general partner at crypto-focused venture capital firm Dragonfly. “That said, it’s clearly bad optics that will raise eyebrows from any creditor committee…Things like unfair access to information and disincentivization of robust price discovery are valid concerns.”

A spokesperson for Galaxy declined to comment on the specifics of the SOL token sales and its special-purpose fund, and it’s unclear precisely how much Novogratz’s Galaxy stands to profit from FTX’s bankruptcy reorganization. Galaxy Digital‘s stock, which trades in Toronto, has gained 161% in the last 12 months and now has a market capitalization of $3.6 billion. According to the company’s Q1 financial statements, as of March 31 Galaxy held a $104.1 million investment in the Galaxy-sponsored Galaxy Digital Crypto Vol Fund, which acquired Solana from the FTX estate during the quarter.

The Official Committee of Unsecured Creditors (UCC) of FTX, consisting of the exchange’s former large customers and market makers, has approved the token sales and FTX’s spokesperson issued a statement in support of Galaxy’s dual role in the bankruptcy reorganization:

“The Bankruptcy Court approved the terms of Galaxy Asset Management’s retention, which were subject to review and objection by parties in interest (with no objections received), including the ability of Galaxy to execute transactions with Galaxy affiliates…The price Galaxy’s affiliate paid for the Solana was the same or higher than the price paid by other buyers for all sales payments received to-date, and all Solana sales were approved by the Official Committee of Unsecured Creditors and the Ad Hoc Committee of Non-U.S. customers. Sales to Galaxy in accordance with the Court-approved framework do not reflect a conflict of interest, and any reports to the contrary are categorically false.”

Still, some FTX creditors and customers are complaining. Listen to Sunil Kavuri, a former FTX customer who had more than $2 million invested with the exchange and is a member of an unofficial “Customer Ad-Hoc Committee” which consists of more than a thousand former FTX.com customers: “I would say that [those managing the bankruptcy] have destroyed in excess of $10 billion, in my opinion. So more than how much Sam Bankman-Fried actually cost us initially,” says Kavuri, who is based in the United Kingdom. “The major costs would be Solana.”

MORE FROM FORBES

Read the full article here